Revving up the startup race: venture capital funds slam the brakes on deals, funding only the most promising!

In the fast-paced world of startups, the engines seem to be losing steam as Venture Capital Funds tighten their grip on the accelerator. Based on the latest data (end of October 2023) from Pitchbook, the funding landscape is experiencing a notable shift – which was initiated in the second half of 2022 – with a reduction in the number of completed deals.

VC funds slam the brake on deals

VC firms are becoming increasingly discerning, carefully selecting only the most promising and deserving startups to support. This change reflects a growing emphasis on quality over quantity, as funds concentrate their resources on backing the truly exceptional companies that have the potential to make a lasting impact in the market.

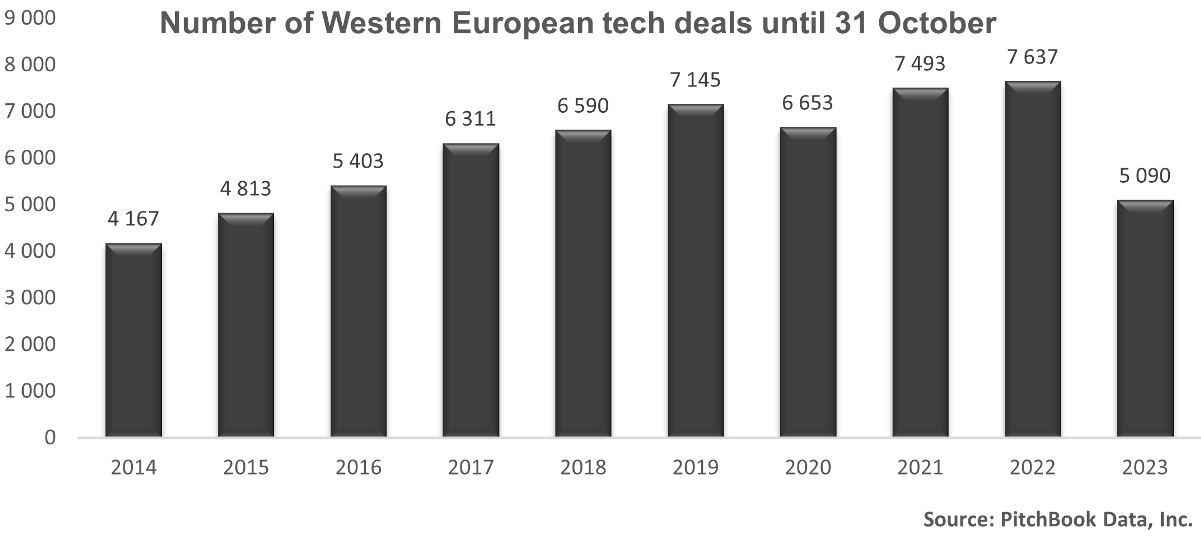

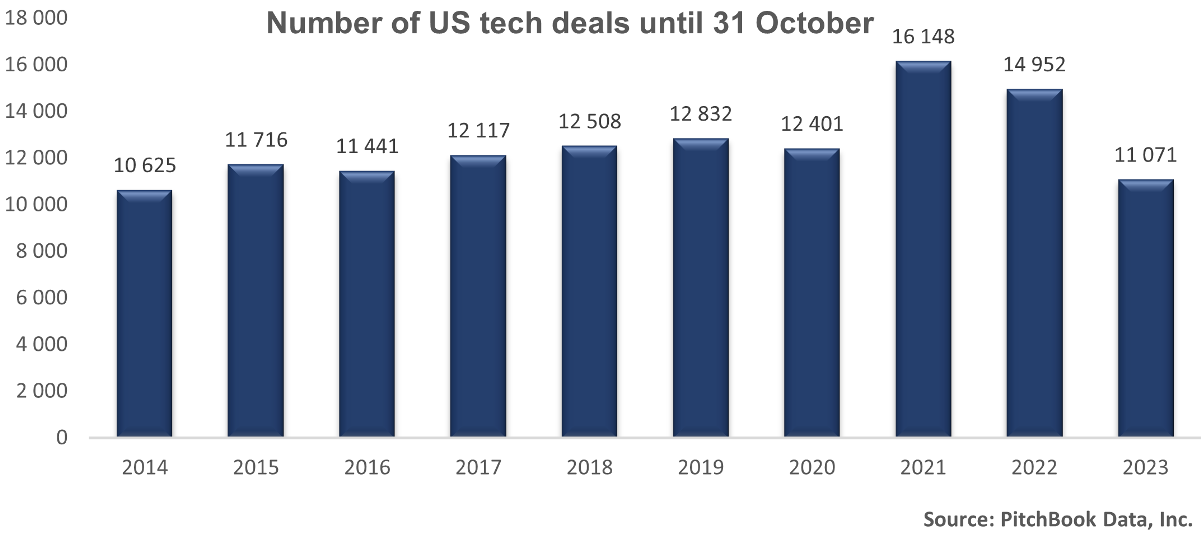

The current fiscal year has witnessed a notable downturn in the completion of venture capital deals, marking a considerable departure from the upward trajectory observed since 2016. This extraordinary reduction in the volume of completed transactions, when evaluated in the context of the past decade, highlights a momentous shift in the market dynamics. Nevertheless, it is crucial to contextualize this development, as comparable trends have emerged across both Western European and American markets.

While the magnitude of the decline may appear alarming, a broader perspective reveals a more nuanced picture of the prevailing landscape. However, one thing remains certain: the startup race is revving up in 2023 and only the most promising contenders will secure the fuel they need to accelerate towards success.

Growth trends – number of tech deals over the past years

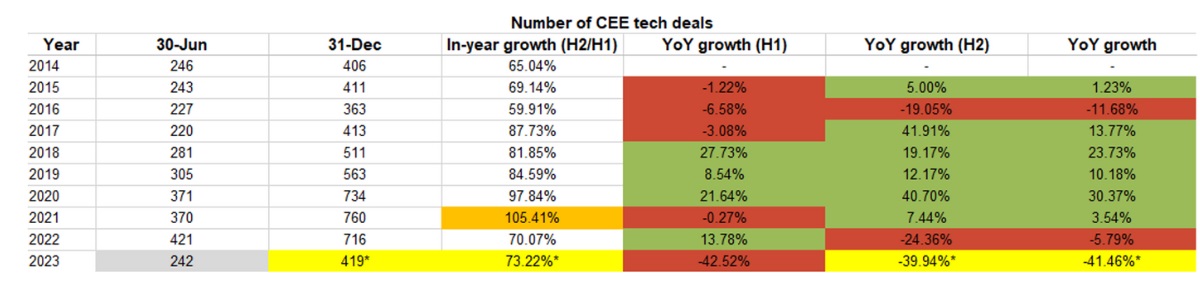

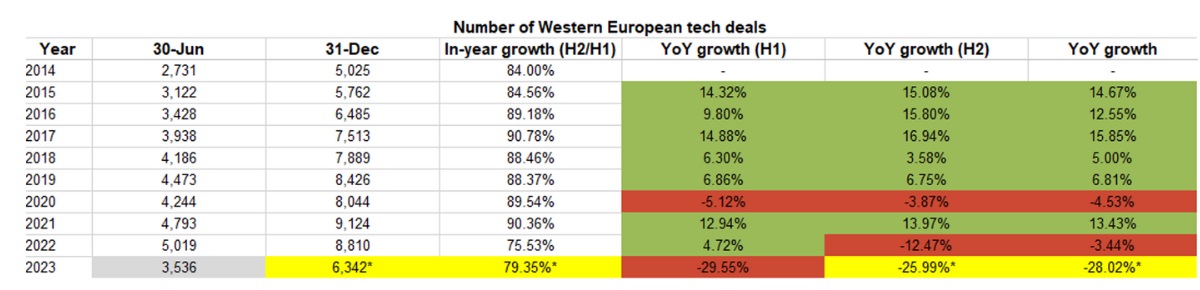

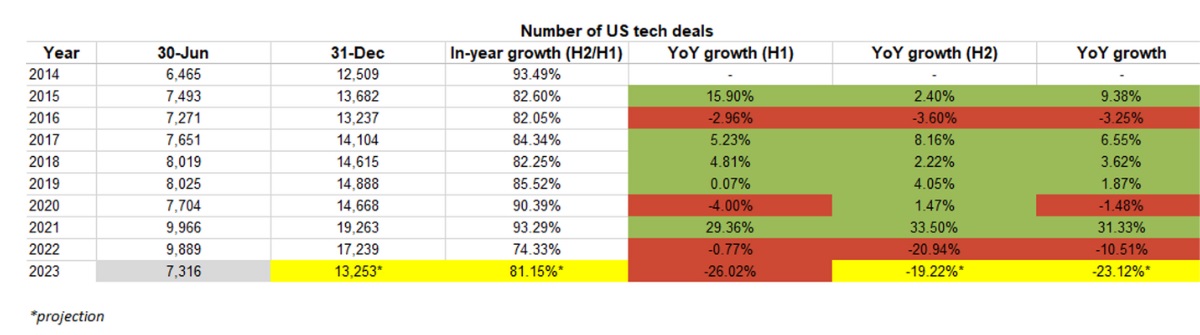

Over the past years, the Central and Eastern European (CEE) region has exhibited a consistent and robust growth trend. As evidenced by the accompanying table, this growth trajectory has been remarkable and sustained, extending until the first half of 2022, with positive year-on-year growth figures recorded from the second half of 2017 until H2 of 2022. It is worth highlighting that the CEE region’s growth rate has demonstrated resilience amidst the challenges presented by the COVID-19 pandemic in 2020, setting it apart from the tech venture capital markets in Western Europe and the USA, which experienced a slight decline during this period. Moreover, it is noteworthy that even prior to the pandemic, the tech venture capital markets in Western Europe and the USA exhibited a slower rate of increase when compared to the thriving CEE venture capital market.

The COVID-19 pandemic, however, proved to be a notable turning point in the trajectory of recent trends, particularly within the CEE venture capital market. Following a period of significant growth, the pace of expansion began to be moderate, contrasting with the Western European and US markets which experienced a remarkable resurgence, with the US market achieving an impressive 31% growth rate within a year. Subsequently, all three markets experienced a considerable slowdown, culminating in a decline six months later. Notably, in 2023, the CEE market experienced the most pronounced downturn following its previous period of robust growth, with only a fraction of the deals being completed compared to the previous year.

The impact of downturn across all stages of VC cycle

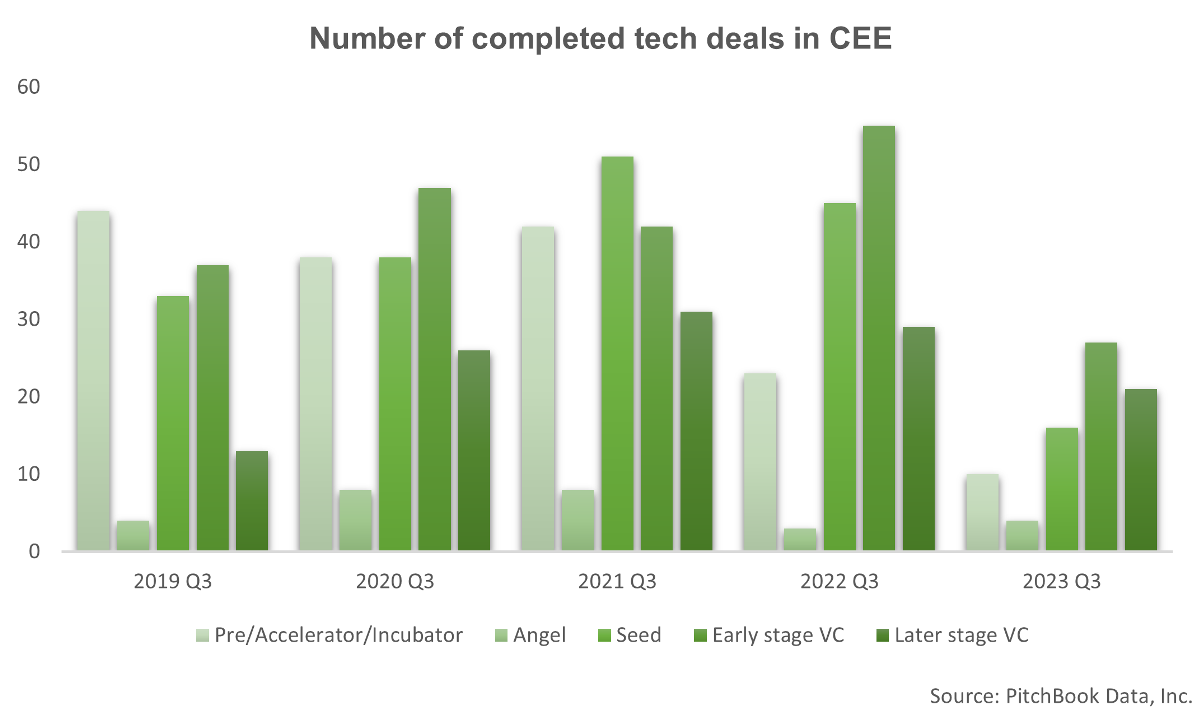

The downturn has inevitably impacted all stages of the venture capital cycle. However, it is important to note that the severity of the impact varied across different stages. As depicted in the graph below, it becomes evident that venture capital firms are not really experiencing a shortage of funds. Rather, they have adopted a more discerning approach, exercised caution and carefully evaluating investment opportunities in startups. Consequently, the later stage, which typically requires a significant infusion of capital, experienced a relatively lesser decline compared to earlier stages.

Venture capital firms are adopting a more selective approach, prioritizing investments that exhibit strong growth potential, sustainable business models, and a clear path to profitability.

Implications on capital investments and average deal sizes

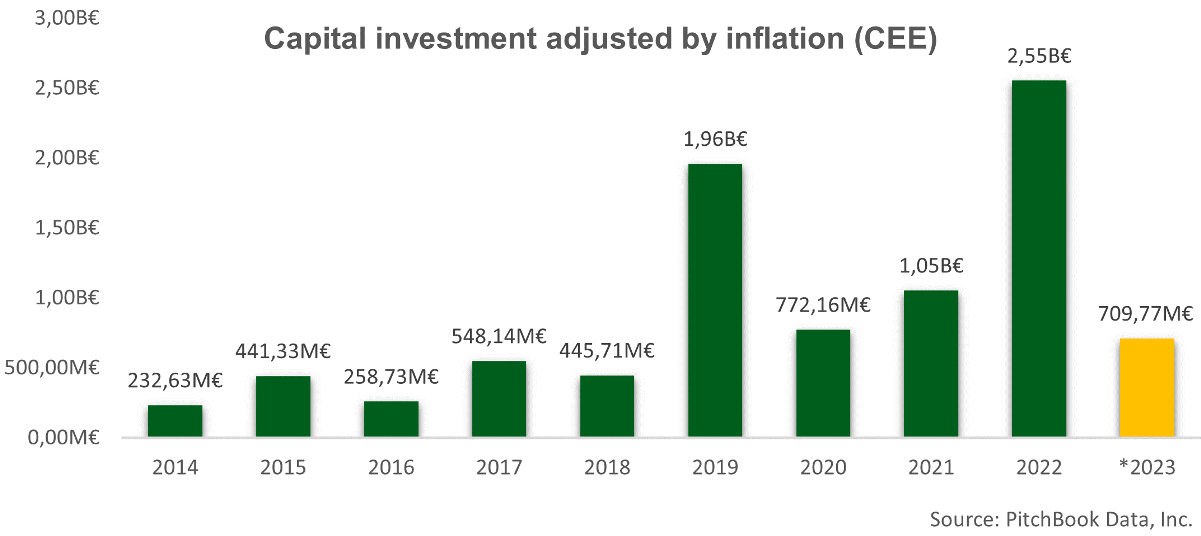

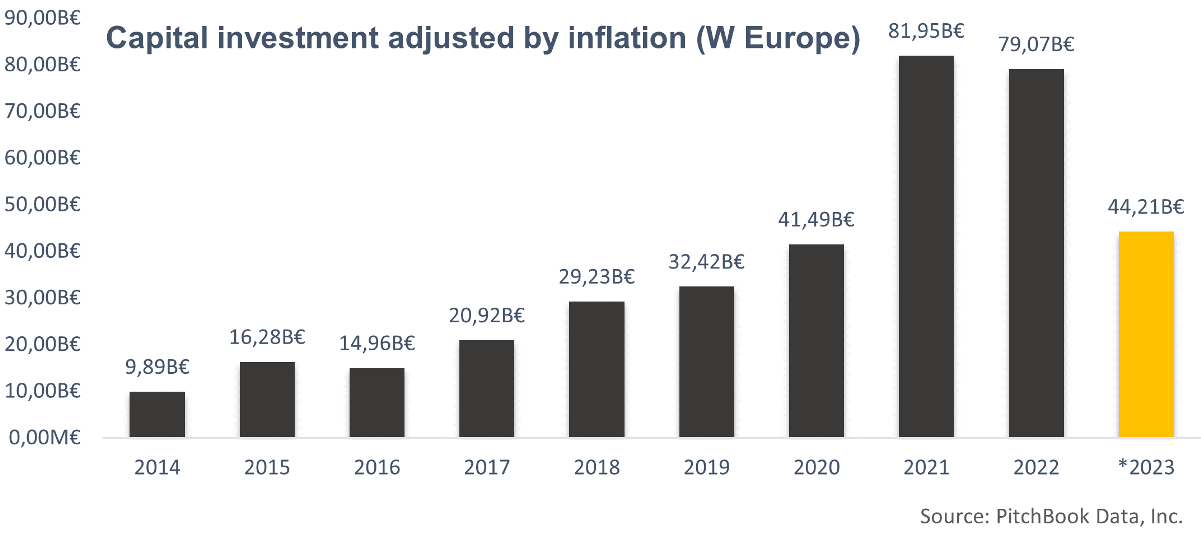

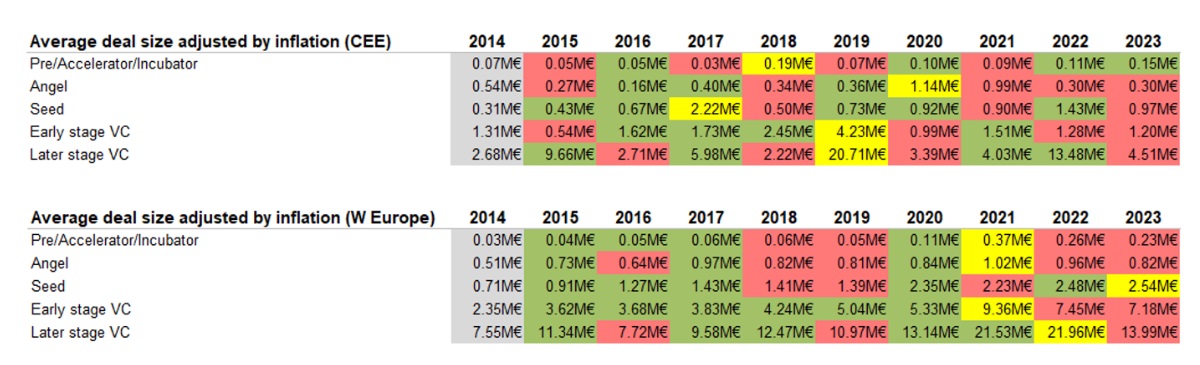

Following an analysis of the volume of successfully closed transactions, it is now imperative to address the implications of the venture capital market downturn on capital investment. The presented graphs indicate a gradual return to pre-COVID levels of capital investment in both Western Europe and the CEE region. Nevertheless, it is important to acknowledge that the extraordinary growth observed in 2021 and 2022 is unlikely to be replicated. As such, the market is now undergoing a process of normalization, marking a transition from the extraordinary highs observed in the previous years.

When considering investments across different stages, there are slight differences between Western Europe and the CEE region. In Western Europe, a unanimous peak was observed in 2021, followed by a gradual and subsequently rapid decline, except for the seed and later stages. Conversely, the CEE region exhibits a less predictable and stable pattern.

The provided tables reinforce the notion that VC firms are not experiencing a shortage of capital, albeit accompanied by a decline in the number of investments. This assertion is supported by the sustained value levels observed in early-stage investments in the CEE region, while angel and accelerator investments didn’t experience notable decreases either. It is worth noting that although later stage investments also declined, such figures can be disproportionately influenced by one or two outliers characterized by exceptionally high investment amounts. In contrast, preceding stages exhibit a more substantial sample size of deals, with fewer extreme values.

So, what key insights and strategic approaches should startups be aware of considering the current circumstances?

- Firstly, they should be prepared for an extended timeline in securing funding. Building and nurturing relationships, as well as leveraging networks, have become increasingly valuable assets in the fundraising process. Startups must prioritize cultivating strong connections with potential investors, industry experts, and strategic partners to enhance their credibility and access to funding opportunities.

- Furthermore, it is crucial for them to be proactive in managing their financial situation. If a startup finds itself in dire need of funding, they should be prepared for the possibility of a downround, wherein the valuation of the company may be lower than previous investment rounds. To mitigate this risk, startups should focus on preserving cash, extending their financial runway, and pursuing organic growth opportunities.

- In this competitive landscape, startups should also reassess their market strategy. It is essential to not only survive but also outperform competitors. By effectively positioning themselves in the market, startups can attract and retain customers, thereby gaining a competitive advantage and potentially expanding their market share.

In the race for startup success, the checkered flag is within reach. As the venture capital landscape shifts gears and funding becomes more selective, only the boldest and most innovative startups will steer their way to victory. So buckle up, rev your engines, and accelerate towards greatness!