Unveiling the hidden dangers of questionable market reports: a must-read for business owners and investors

‘Hello Sir, are you interested in the global time travel machine market and how it’s poised to be booming in the coming years? If so, it’s your lucky day, because I’m presenting you with a once-in-a-lifetime offer – a market report available to you for an unbelievably discounted price of only 3300 dollars.’

The anecdote above serves as an extreme example of a shady market research company. However, they are more concerning than amusing, as they can easily mislead anyone regarding the trends and expectations in any market segment.

In this post, we’ll guide you through the challenging landscape of questionable market reports. By the time you finish reading, you’ll be equipped with the tools to identify doubtful data and safeguard your decisions and investments.

Our experience in this field

At Absolvo Consulting, daily comprehensive market analysis is an integral part of our work. With a primary focus on the technology sector, we thoroughly examine market size and trend progression within a wide array of studies sourced from multiple channels. Our method involves delving beneath the surface to critically evaluate the underlying data. This rigorous analytical approach equips us to accurately assess demand for a company, its promising opportunities, predict potential deals, investor appetite or pinpoint regions with the most promising activity. Our standard procedure includes checking multiple market studies concurrently for each project. Consequently, we’ve identified anomalies in various market reports, shedding light on significant disparities in expectations and projections.

The case study revealing essential insights

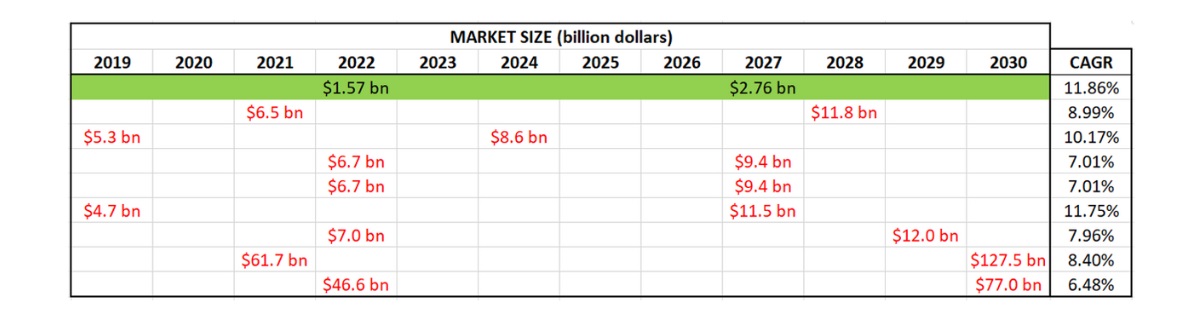

During one of our projects, we conducted an examination of a niche market in the IT industry. The results of this analysis serve to vividly highlight the stark contrast between trustworthy and dubious market reports. We compared the forecasts provided by a single reputable research company (in green) with those offered by eight less reliable research firms (in red), and the findings are quite enlightening. In each row, the first value signifies the current estimated market size, while the second value denotes the projected market size.

In this specific niche market, the estimated market size was roughly four times greater when considering the average questionable research company in comparison to the evaluation of the industry expert. However, instances of extreme ‘over-estimations’ were also observed, with projections reaching levels 30 to 40 times higher than the actual market size. These exaggerated base market size estimates significantly influenced the forecasts. Consequently, even though the Compound Annual Growth Rate (CAGR) is the highest in the case of the trustworthy firm, its projections remain the most conservative, resulting in the smallest anticipated market size.

Background checks are necessary

While in some cases, the forecast numbers themselves may raise a few eyebrows, most of the time, they aren’t that unusual. This is especially true when your rational sense is somewhat clouded by the hope of your niche segment being the one with the most significant growth potential. If you’re not relying on data from a renowned industry authority, it becomes crucial to conduct a background check on the source.

In our experience, well-founded research takes substantial staff and resources to produce, as extensive data acquisition and primary research is required for meaningful insights. Respectively, several renowned research companies are specialists in their selected fields, with a relatively narrow focus of industries.

This raises doubts about the credibility of relatively unknown companies that claim to offer an extensive collection of reports or claim to cover a wide range of industries. It’s also worth noting that dubious market research companies often target niche segments where reliable data is scarce or entirely unavailable.

Another key characteristic we’ve observed is that questionable market research firms tend to maintain a front-end presence in the EU or US, with their backend operations often situated in other geographic locations (e.g. several back-end operations of questionable research entities may be found in India, however, it’s important to emphasize that not every Indian market research firm provides dubious data). What’s particularly noticeable, though, is the consistent presence of market reports of dubious companies on the first pages of Google search results. This observation implies that they invest significantly in SEO services, ensuring their high visibility in search listings.

Negative consequences

Frequently, we come across mentions of dubious market reports within companies’ materials, such as pitch decks. This situation can be detrimental for both startups seeking investment and companies aiming to attract potential buyers. Inaccurate data has the potential to impact a company’s valuation and the expectations of its stakeholders, sometimes even leading to a deal falling through. Moreover, it can erode a company’s credibility in the eyes of investors who are aware of those market segments (with several active investments) or have conducted thorough research and identified exaggerated or inaccurate figures. Such discrepancies can somewhat tarnish a company’s professional image.

Conversely, investors can likewise experience adverse consequences resulting from an inaccurate approach. This could lead to overpaying for a company or having unrealistic expectations based on improper market projections provided by the seller. In light of these scenarios, it’s evident that using accurate, reliable data in company materials is mutually beneficial for both parties involved in a deal.

The vital takeaways

- Don’t put all your faith in the first Google search results.

- Always use multiple sources.

- Don’t immediately swallow the sugar-coated figures; seek data from credible experts.

- Always check the research company’s fields of expertise and background.

- Trust accurate forecasts for your industry as a whole rather than relying on questionable specific niche data.

- Only invest in reports when you’re absolutely certain of their authenticity.