Tech savvy & wealthy: Ranking Europe’s top 10 Private Equity firms by dry powder for tech deals

Private equity firms play a crucial role in funding and supporting the growth of companies across industries, including Information Technology and tech-enabled services. In this blog post, we will explore the top European private equity firms with the largest dry powder and strong focus on investing in tech companies across Europe.

We will provide an overview of each firm’s investment strategy, their dry powder, and their successful investments and exits, primarily in the tech sector, based on Pitchbook data available until April 2023. The following firms have the capability to offer capital and strategic support that are essential for companies wanting to achieve significant growth.

Top 10 European PE firms by dry powder available

10. AlpInvest Partners

Dry Powder: 8.84 billion EUR

HQ: Amsterdam, The Netherlands

Web: https://www.alpinvest.com/

AlpInvest Partners is a highly experienced global private equity firm with a substantial dry powder of 8.84 billion euros, managing an impressive 59 open funds and overseeing assets under management exceeding 60 billion euros. Renowned for its track record of over 1,000 successful investments and a dynamic portfolio of 49 companies, AlpInvest has established a sterling reputation for its acumen in recognizing and allocating capital to cutting-edge enterprises across diverse sectors.

AlpInvest has made astute investments in an array of companies, exemplified by its acquisition of Profi Rom Food, a leading European retail chain based in Romania, in February 2017 for 575 million euros through a co-investment, buyout deal. Additionally, AlpInvest has demonstrated its prowess in the telecommunications sector through its strategic investment of 202 million euros in Euskaltel, a Spanish telecommunications company, in October 2012 as part of a co-investment growth deal. Notably, AlpInvest has played a pivotal role in fostering the remarkable growth of Euskaltel during its ownership tenure, culminating in a successful exit in August 2021 for a substantial 2 billion euros, delivering impressive returns to its investors. Apart from Euskaltel and Profi Rom Food, AlpInvest’s investment history boasts a roster of well-known companies, including Cushman & Wakefield and Avaya.

With a legacy of more than 250 successful exits, AlpInvest has firmly established itself as a trusted partner for generating significant returns through strategic investments and value creation. The firm remains steadfast in its commitment to fostering the growth and development of its portfolio companies and has a proven track record of successful collaborations with visionary leaders in the business world.

![]()

9. Bridgepoint Advisers

Dry Powder: 9.99 billion EUR

HQ: London, UK

Web: https://www.bridgepoint.eu/

Bridgepoint Advisers, a leading private equity entity, has a robust collection of 14 investment funds and oversees an astonishing 40 billion euros in managed assets. Acclaimed for its exceptional talent in discerning and investing in revolutionary companies across a wide range of industries, including the field of information technology, the firm boasts a remarkable history of achievements with more than 600 prosperous investments and a dynamic portfolio of 70 active companies. Armed with a substantial reserve of 9.99 billion euros as dry powder, Bridgepoint Advisers is aptly equipped to seize profitable prospects in the dynamic market landscape. The company primarily invests across four verticals, which are advanced industrials, business and financial services, consumer, and healthcare, with technology as a horizontal connected to everything everywhere.

Among its successful investments, Bridgepoint Advisers acquired Dr Gerard, a Polish food company in October 2013 through an LBO. Additionally, in January 2015, the firm made a successful investment in eFront, a renowned software provider of alternative investment management solutions, with a leveraged buyout worth 430 million euros. During its ownership period, Bridgepoint Advisers demonstrated its expertise in the sector by supporting eFront in achieving substantial growth. In May 2019, the firm successfully exited its investment in eFront for 1.16 billion euros, resulting in significant gains for its investors.

![]()

8. Nordic Capital

Dry Powder: 14.08 billion EUR

HQ: Stockholm, Sweden

Web: https://www.nordiccapital.com/

Nordic Capital is a distinguished global private equity firm that boasts a dry powder of 14.08 billion euros, managing 5 open funds and holding assets under management worth 25 billion euros. With over 400 total investments and an active portfolio of nearly 50 companies, Nordic Capital has a history of uncovering and placing investments in pioneering, growth-oriented companies across various industries, including information technology. Furthermore, Nordic Capital is dedicated to investing in companies that proactively address global challenges, contribute to building a prosperous society for all, and promote transformative sustainable change.

One of Nordic Capital’s remarkable investments in the IT sector was back in 2012 when it successfully completed a leveraged buyout (LBO) of Itivity Group, a Dutch software and IT services company, valued at 228 million euros. Over the course of nine years, Nordic Capital played a pivotal role in Itivity Group’s growth journey by facilitating the expansion of its product portfolio, customer base, and market position. The result was an outstanding achievement as Itivity Group was eventually sold for a staggering 2.14 billion euros in May 2021, realizing major profits to Nordic Capital’s investors. Besides Itivity Group, the Swedish private equity firm invested in other influential companies, such as Lindorff Group or Bank Norwegian.

Nordic Capital is renowned for its investment approach, which centers on long-term growth and value creation. The firm has established itself as a trusted partner for visionary company leaders who aspire to expand their businesses. Boasting a track record of over 110 successful exits, Nordic Capital has earned a sterling reputation for generating impressive returns for its discerning investors.

![]()

7. Cinven

Dry Powder: 15.35 billion EUR

HQ: London, UK

Web: https://www.cinven.com/

Cinven, a prominent global private equity firm with an impressive dry powder of 15.35 billion euros, manages seven open funds and oversees assets under management worth more than 30 billion euros. With a robust performance record of identifying and investing in progressive, expansion-minded companies across various sectors, including information technology, Cinven has established itself as a leader in the industry. One of the firm’s current funds has been named a Real Deals ‘Future 40 ESG Innovator’ which underscores Cinven’s special focus on making positive economic, social, and governance impacts through their investments.

Cinven’s extraordinary expertise in the tech sector is proved by several notable investments. One of these was the leveraged buyout of CPA Global, a leading intellectual property management company based in the United Kingdom, valued at 1.14 billion euros in 2012. Under Cinven’s guidance, CPA Global experienced major growth over the course of five years, showcasing Cinven’s ability to create value. In 2017, Cinven successfully exited CPA Global for 2.69 billion. It is a great example of the company’s rich history, which includes around 170 successful exits. Due to this fact, the company has a strong reputation for garnering considerable profits for its investors.

![]()

6. Intermediate Capital Group

Dry Powder: 22.08 billion EUR

HQ: London, UK

Web: https://www.icgam.com/

Intermediate Capital Group (ICG) is a highly regarded private equity firm that specializes in investment management and corporate finance. With a significant dry powder of 22.08 billion euros at its disposal, the firm expertly manages 34 open funds and boasts an active portfolio of 70 companies and a staggering 70 billion euros in assets under management. The London-based firm is committed to fostering a future workforce that prioritizes diversity as a core value. In ICG’s 2020 graduate programme, an impressive 63% of participants were female, while 37% identified as belonging to an ethnic minority group. Additionally, the firm actively supports young individuals from underserved communities through various initiatives and programs.

ICG has an exemplary history of prosperous investments spanning various industries, including the lucrative IT sector. In September 2017, the firm co-invested a substantial 1.53 billion euros in Norwegian Visma Group, a leading provider of cutting-edge business software and cloud services, in a secondary transaction. This investment underscores ICG’s astute acumen in identifying companies with innovative products and services.

Furthermore, ICG has a rich history of successful exits, with over 300 notable exits to its name, including the profitable exit of Poland-based media and communication service provider Aster City Cable in September 2011. This remarkable expertise emphasizes the firm’s commitment to delivering outstanding returns for its esteemed investors. ICG’s noteworthy investment in Visma Group, combined with its extensive experience and a history of lucrative exits, positions it as a compelling option for companies seeking exceptional growth and expansion opportunities.

![]()

5. CVC Capital Partners

Dry Powder: 23.55 billion EUR

HQ: Luxembourg, Luxembourg

Web: https://www.cvc.com/

Renowned for its exceptional reputation and formidable prowess, CVC Capital Partners stands as a distinguished private equity firm with a noteworthy dry powder of 23.55 billion euros dispersed among its seven active funds. The company prides themselves on integrating ESG within their operations and investment processes. With the aim of producing sustainable value for their portfolio companies and investors, the firm had near 1,000 total investments before, and currently manages over 150 thriving organizations that collectively amass a mammoth 137 billion euros in assets under management.

The firm’s unparalleled expertise in the ever-evolving realm of information technology renders it an irresistible choice for visionary leaders in search of investment opportunities. A prime example of CVC Capital Partners’ keen acumen in the IT sector is its strategic investment in Avast Software, a pioneering provider of PC security software based in the Czech Republic, a move made in March 2014. The Luxembourg-based company further proved its commitment to nurturing innovation and fostering growth in the digital industry, by co-investing with Summit Partners in AVG Technologies, a Czech cybersecurity firm, through a public-to-private leveraged buyout (LBO) transaction valued at 1.25 billion euros in September 2016. Both deals showcased the firm’s ability to identify and capitalize on the potential of promising tech companies poised for exponential growth.

Notably, the firm’s track record extends beyond investments, as exemplified by its successful exit from its investment in Formula One in July 2017, a company it had acquired in 2006. This exit marked a triumphant return for CVC Capital Partners and served as a testament to its ability to yield considerable profits for its esteemed investors.

4. Permira

Dry Powder: 25.06 billion EUR

HQ: London, UK

Web: https://www.permira.com/

With over 500 total investments and 75 billion euros in assets under management, Permira is a renowned private equity firm recognized worldwide for its specialized knowledge and proficiency in investing in companies. Permira always looks for the opportunity to partner with disruptive technology, tech-enabled and category-creating organizations led by visionary management teams. Boasting a dry powder of 25.06 billion euros and managing 17 open funds further strengthens Permira’s reputation in the IT industry and makes the company a preferred choice for tech firms on the verge of transactions.

In a public-to-private leveraged buyout (LBO) deal worth 5.47 billion euros, Permira co-invested with Canada Pension Plan in Mimecast, a London-based leading company specializing in email security and cyber resilience. This investment demonstrates Permira’s ability to identify innovative tech firms. Besides its notable impressive investment performance, Permira has a strong history of exits, as the company has done more than 160 such transactions successfully. This expertise spotlights the firm’s commitment to generating significant returns for its investors and many well-known past and present portfolio companies, such as McAfee, Zendesk, or Hugo Boss further solidify Permira’s reputation as a premier option for tech companies in search of an investor.

![]()

3. Hg

Dry Powder: 25.28 billion EUR

HQ: London, UK

Web: https://hgcapital.com/

Hg is widely recognized as a distinguished private equity firm with a formidable track record of investing in companies poised for growth. Boasting a substantial war chest of 25.28 billion euros in unallocated capital, the firm adeptly manages a diverse portfolio of 33 open funds. Hg’s dynamic portfolio presently comprises 53 companies, collectively valued at approximately 50 billion euros in assets under management. The London-based private equity firm has a core expertise in funding and supporting businesses operating in the software and technology-enabled sectors, including software-as-a-service (SaaS), cloud computing, cybersecurity, fintech, and healthcare technology.

This deep domain knowledge and experience in the sector is showcased in Hg’s history of transactions. In March 2019, the firm invested in Transporeon, a leading cloud-based logistics platform located in Germany, through a leveraged buyout worth 706 million euros. Hg recently exited its investment in Transporeon for 1.88 billion euros, meaning that the company has now made more than 120 successful exits. Additionally, Hg has made illustrious investments in companies such as The Access Group and Visma Group, both in the IT sector. These achievements exemplify the firm’s ability to identify innovative and growth-oriented companies and provide them with support to realize their potential.

![]()

2. EQT

Dry Powder: 31.42 billion EUR

HQ: Stockholm, Sweden

Web: https://eqtgroup.com/

EQT, a premier private equity firm with a global reach, is an excellent choice for tech companies seeking capital to propel their growth. Through 31 open funds the firm has a significant dry powder of 31.42 billion euros, which it uses to fund growth-oriented organizations across various industries. The Stockholm-based company is dedicated to sustainable investment and focuses on making positive environmental, social, and governance (ESG) impacts through their capital deployment. As of now EQT has close to 150 active portfolio companies, amounting to a substantial 114 billion euros in assets under management.

EQT’s investment in foodtech company SNFL Group in March 2022, a co-investment with AM FRESH Group and Paine Schwartz Partners, saw the firm lead a 1.6 billion euros growth round in the Spanish company. Two months later, EQT also made a successful exit from Wolt, a Finnish food delivery startup, after it had acquired the company in 2019. This exit emphasizes EQT’s capacity to enhance the value of its portfolio firms, in addition to its ability to deliver profitable outcomes to its stakeholders. A deep understanding of the IT industry and a proven track record of successful investments and exits means Swedish EQT is a top choice for either a buyout or a growth round.

![]()

1. Ardian

Dry Powder: 39.51 billion EUR

HQ: Paris, France

Web: https://www.ardian.com/

Ardian, one of the world’s largest private equity firms, presents a compelling choice for companies pursuing growth. With an impressive dry powder of 39.51 billion euros, the company’s investment strategy is to provide flexible capital to organizations in various industries, including IT. The firm had approximately 1,300 total investments in the past and manages 31 open funds currently. Ardian has a diverse active portfolio of around 200 companies, amounting to a staggering 130 billion euros in assets under management.

Ardian’s investments in Taxually, the Hungarian start-up providing tax reporting solutions and Poznan-based Allegro showcase the firm’s interest in the technology sector – Ardian co-invested in the Polish and European e-commerce market leader’s 3.1 billion euros buyout in January 2017, which is one of the largest transactions in the industry in the CEE region. Ardian has also made notable investments in other tech companies such as TDF Group in France or WorldPay in London.

A successful exit from Vivacom in November 2012 highlights Ardian’s ability to create value and generate substantial returns for their investors. Vivacom, a leading Bulgarian telecom operator, was sold for 1.2 billion euros, which was a significant achievement for the French private equity firm. With their knowledge and capabilities, Ardian is equipped to provide business guidance and agile capital to fund the expansion of established companies, offering the necessary support for growth.

And +1, as the most active technology investor in the CEE region

![]()

MCI Capital

Dry Powder: 51.67 million EUR

HQ: Warsaw, Poland

Web: https://mci.pl/en

As the most active technology investor in the CEE region, MCI Capital rightfully earns a place on this illustrious list. The prominent Polish private equity firm boasts a distinguished track record of over two decades in unlocking substantial value from IT investments, with a keen focus on the flourishing fintech, e-commerce, and digital media sectors (btw, we also supported our Client in an M&A deal with it). With a robust financial position, including significant dry powder of 51.67 million euros, and managing assets under management (AUM) totalling 576 million euros, MCI Capital is a formidable player in the industry.

Setting them apart is their proactive and hands-on approach with portfolio companies, characterized by strategic and operational support, leveraging their extensive network of industry contacts and resources to drive value creation initiatives. Their commitment to responsible investing is evident in their meticulous integration of sustainability and ethical considerations into their investment decision-making process, aligning with the ever-growing demand for responsible and ethical investment practices in the technology sector.

Noteworthy exits from MCI Capital’s portfolio include prominent companies such as Zettle by PayPal, Lifebrain, and Polish Allegro, underscoring their ability to deliver successful outcomes for their investments. A prime example of their expertise is their 2017 acquisition of Hungary-based Netrisk through a leveraged buyout (LBO) worth 56.5 million euros, followed by a successful partial exit just three years later, yielding a remarkable 55 million euros and retaining an approximate 24% share in the company. The Warsaw-based private equity firm managed another impressive transaction successfully in December 2018, by acquiring Polish tech company IAI SA through a public-to-private LBO. MCI Capital’s extensive experience, hands-on approach, commitment to responsible investing, and robust financial position exemplify their status as a reliable partner for technology entrepreneurs in Central and Eastern Europe (btw, we also made deal with them).

Private equity – active past years, bright future

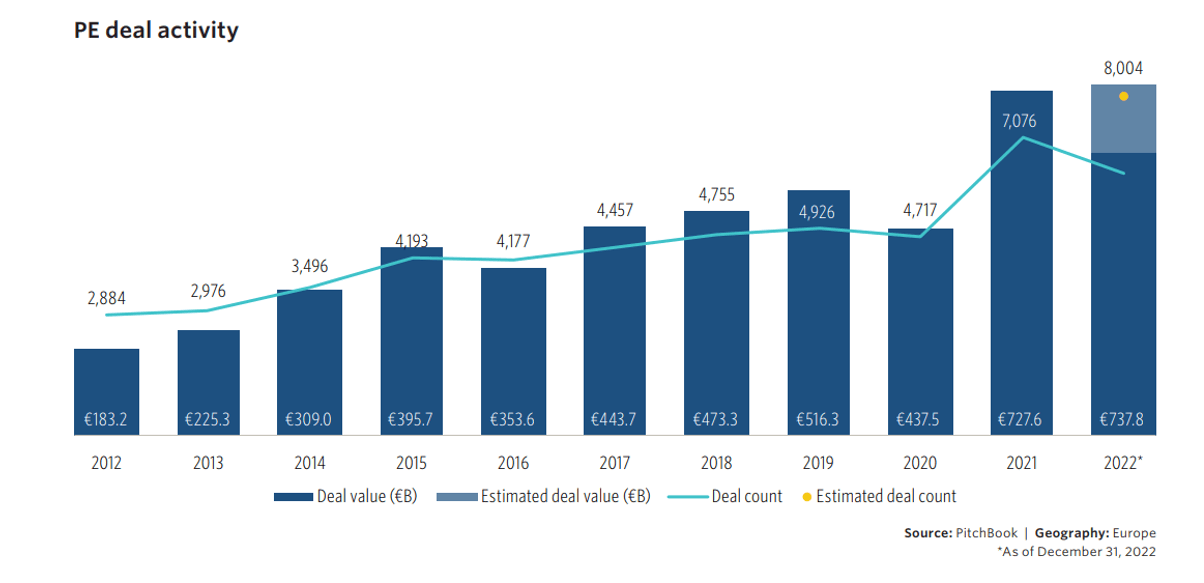

The private equity market has a promising future, as demonstrated by its remarkable activity in 2021 and 2022. Record-breaking transaction values and volumes, driven by ample dry powder available to firms, highlight the industry’s strength and potential.

PE players have been actively utilizing their dry powder to expand their portfolio companies and drive M&A market activity, underscoring their ability to capitalize on investment opportunities. The diversification across sectors, such as healthcare, technology, energy, and real estate, further strengthens the market’s resilience and potential for sustained growth. Overall, the private equity industry is poised for a bright future, with PE firms driving M&A market activity and contributing to the industry’s ongoing success.